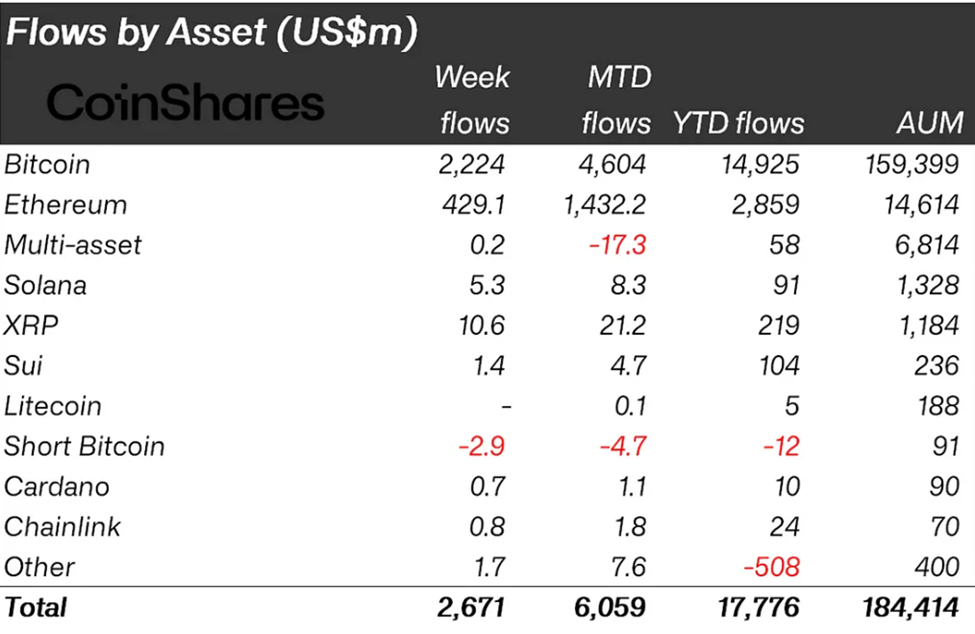

Crypto inflows are moving with quiet force, totaling $2.7 billion last week after a sustained 11-week streak of positive flows.

This brings 2025’s half-year (H1) inflows to $16.9 billion, just shy of the $17.8 billion recorded in all of H1 2024.

Bitcoin Captures $2.2 Billion as Crypto Inflows Extend an 11-Week Winning Streak

With crypto inflows nearly matching 2024’s record H1 pace, data suggests institutional conviction is holding firm amid a complex global backdrop.

According to the latest CoinShares research, the bulk of last week’s flows were concentrated in the US, contributing $2.65 billion.

Unsurprisingly, Bitcoin led the inflow charge, absorbing $2.2 billion or 83% of last week’s total. This reflects a broadly optimistic sentiment toward the pioneer crypto.

This is especially true, as short-Bitcoin products shed another $2.9 million, bringing year-to-date (YTD) outflows for bearish bets to $12 million.

Ethereum raked in $429 million, pushing its 2025 inflows to $2.9 billion. These positive crypto inflows extended Ethereum’s streak of successive bullish capital influxes.

BeInCrypto reported recent instances, including three weeks ago, when Ethereum recorded its strongest run since the US elections.

To some extent, Ethereum’s Pectra Upgrade has driven positive sentiment for the altcoin. Solana, by contrast, has seen just $91 million this year.

This latest crypto inflow surge builds on the $1.2 billion recorded the week before and $1.9 billion the week before that. The crypto market has seen nearly $6 billion in inflows over the last three weeks alone.

This is a remarkable show of resilience amid mounting global risk. Behind this momentum lies a steady confluence of macro drivers.

“We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy,” CoinShares’ head of research James Butterfill wrote.

Global Macro Forces Keep Crypto Inflows on Track

As BeInCrypto reported last month, the Moody’s downgrade of the US credit outlook cast a shadow over traditional markets, prompting a renewed search for uncorrelated alternatives.

Two months ago, investor appetite appeared undeterred even as President Trump’s tariff threats roiled markets. This points to traders and investors looking past geopolitical noise and pricing in longer-term structural demand for crypto.

Meanwhile, monetary policy uncertainty remains a persistent tailwind. The Federal Reserve (Fed) has wavered on the timing of interest rate cuts, leaving markets hyper-sensitive to each economic print.

This environment has offered macro-savvy investors a trading compass, with many allocating to crypto as a hedge against inflation and dollar volatility.

That thesis now seems to be gaining traction. The consistent crypto inflows, particularly Bitcoin and Ethereum, signal growing alignment between crypto and traditional finance (TradFi) in interpreting macro signals.

Even with equities chopping sideways and bond yields rising, digital assets are consistently attracting capital, suggesting a shift from speculation to strategic allocation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment