Allegations that Wall Street is deliberately suppressing Bitcoin’s price are nothing new—but according to James “Checkmate” Check, they’re nothing more than fiction. In a wide-ranging appearance on the G’day Bitcoin podcast, the Check on Chain analyst directly addressed the conspiracy theories circulating across X, asserting that the appearance of price stagnation is entirely natural—and misunderstood.

Is Bitcoin Being Held Down?

“The number one source of price suppression is people’s boredom,” Check said early in the interview, responding to a wave of online frustration about Bitcoin’s apparent refusal to rally despite consistent institutional demand. In his view, the idea that the price is being “held down” by some external manipulator fails to grasp the basic mechanics of markets: every buyer requires a seller.

At the heart of the claim is a contradiction. Users on X point to billion-dollar purchases from entities like Strategy and ask why the price has gone nowhere. Check’s answer was as simple as it was blunt: “People are selling billions of dollars to Saylor.” That’s how the price stays flat.

The misconception, he argues, stems from a flawed understanding of how markets absorb liquidity. “It’s just really, really simple,” he repeated. “When you hit the buy button, you don’t want the market to send. Saylor wants to buy and then the market moves, right? That’s just how markets work. Get over it.” Far from being evidence of foul play, the sideways action—what he calls “chop-solidation”—is a normal, healthy process in which markets digest previous gains.

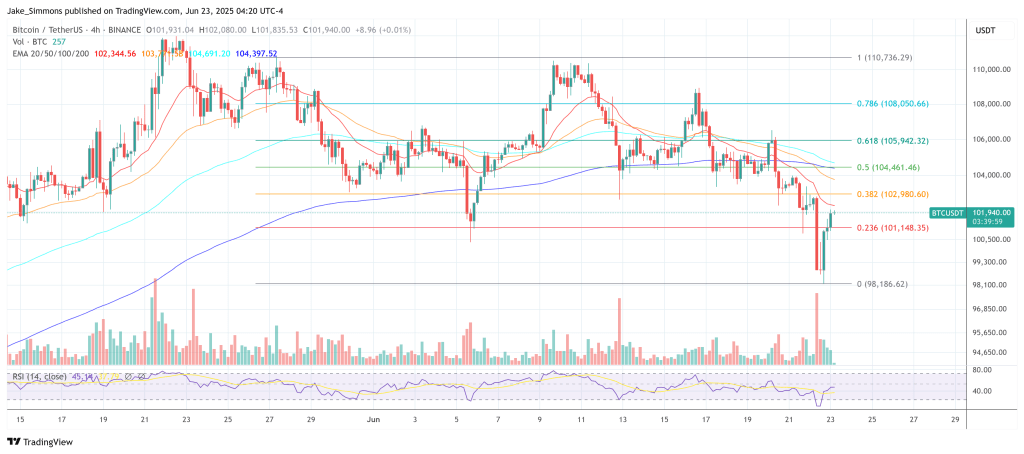

He explained the term “chop-solidation” as a fusion of technical consolidation and the Choppiness Index, a volatility oscillator that signals the degree to which a market is trending or ranging. The current period of stasis, hovering above $100,000 for weeks, follows an aggressive multi-month rally from the post-FTX lows. In such conditions, according to Check, a pause is inevitable. “Markets cannot go up or down in a straight line.”

But why does the idea of manipulation persist? For Check, it’s psychological. “People get so bored,” he said. “They start concocting these stories.” He likened the current mood to earlier phases in the cycle—$20–$30K in 2023, or the long sideways movement between $45K and $75K. In both cases, people cried manipulation, only for the market to eventually break higher.

The real frustration, he suggests, lies in investors’ emotional volatility, not price volatility. “You’re a stone’s throw from the all-time high,” he said. “It goes down to go up. Like, that’s so often how this plays out.” Either the market spikes violently upward, catching traders off guard, or it dips just enough to trigger fear and capitulation—before snapping back and leaving skeptics behind. “People will capitulate and panic and then it will just springboard straight up to new all-time highs.”

Chop-Solidation Is Needed

In Check’s view, the pattern is clear. Consolidation after expansion. Panic after boredom. Breakout after capitulation. There is no need to invent dark motives. “This is how bottoms get formed.” And if you’ve been around Bitcoin long enough, he implies, you’ve seen this movie before.

His broader message is aimed at calming emotional overreactions. “Chop-solidation is part of the process,” he insisted. “That’s how markets work.” Far from being orchestrated by institutions to accumulate at low prices, the range-bound nature of Bitcoin is the market’s way of preparing for the next leg—whether up or down.

In sum, Check dismantled the manipulation narrative with a data-backed, experience-driven view: the illusion of suppression isn’t a function of centralized control but of collective impatience. The price isn’t rigged—it’s resting. And when it moves, it won’t be because of a conspiracy. It’ll be because the market, as it always does, is simply doing its job.

At press time, BTC traded at $101,940.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Be the first to comment